SPACESHIP.COM - UNBEATABLE $4.98 Dot Com Domain Registrations

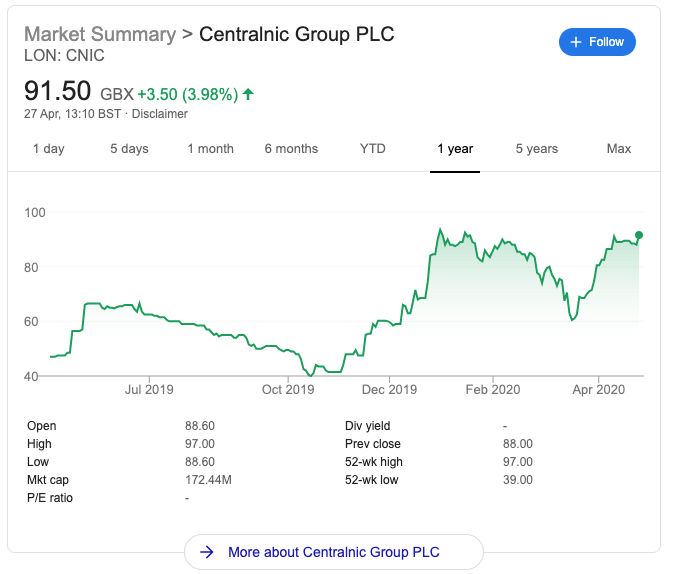

In a story today in the news, it talks about CentralNic who acquired Team Internet seeing their expenses jump 39% from $29 Million to $40.5 Million, this, however, is typical with a business that has a lot of acquisitions, there will always be short term burn of cash until they align and start to make business synergies across both functions where overall expenses such as SG&A is reduced and overheads make more sense across the group – The share price of CentralNic has held well this year and I expect it to continue, would you buy shares in Centralnic?

(Alliance News) – CentralNic Group PLC on Monday said its loss widened sharply in 2019 as administrative expenses and finance costs more than offset a revenue boost from acquisitions.

Domain name and web services provider CentralNic reported a USD8.2 million pretax loss for 2019, far wider than 2018’s loss of USD5.0 million.

Revenue almost doubled to USD109.2 million from USD56.0 million, boosted by the first full year of revenue from KeyDrive, acquired in August 2018, and from Globehosting, bought in September 2018.

However, CentralNic’s administrative expenses jumped 39% to USD40.5 million from USD29.1 million and finance costs multiplied to USD7.8 million from USD1.5 million, resulting in a pretax loss.

CentralNic acquired Team Internet AG in December 2019, and this is expected to benefit its 2020 performance. So far, the integration of Team Internet is proceeding as planned, and it made a “pleasing contribution” to CentralNic’s first quarter.

Chief Executive Ben Crawford said: “The group trading in Q1 2020 was in line with our expectations, despite the global business restrictions to slow the progress of Covid-19. As some of our companies are considered critical infrastructure, our group has a long history of being focused on business continuity, which prepared us well for switching our staff to working from home while providing undiminished service to our customers.

“As a profitable provider of online subscription services with high cash-conversion and solid organic growth, we do not expect CentralNic to be severely affected by Covid-19, but we will continuously review our acquisition and financing strategy to ensure that we maintain stability and optimise our business strategies in the new global climate.”

CentralNic’s shares’ were up 8.5% at 95.50 pence in London on Monday morning.

By Anna Farley; annafarley@alliancenews.com

Copyright 2020 Alliance News Limited. All Rights Reserved.